Trade Nivesh Election 2019 Effect on

Indian Stock Market

Elections are a mega carnival in India with people from all walks of life actively participating in the process. The next General Election is scheduled to take place between April-May 2019. It is a short distance away and it is going to be a “Litmus Test” for the present government. The outcome of the election will determine the growth trajectory of India. Its importance can be mapped in three ways:

It is going to be the first national level election after demonetization, GST and surgical strike.

And the second fact is that after demonetization most of the state and municipal elections have been won convincingly by the BJP and there is always a “joker in the pack”.

On 30th April, 2018 the desideratum for rural electrification has been accomplished.

A Pre-Election Break-Up For 2019 Lok Sabha Election Of People’s Opinion Is Depicted Below

Rarely a Prime Minister gets one fifth score for OUTSTANDING and one fourth as RISK TAKER. So, on an average 86% of votes are in favour and 14% are against. Similarly 55% of the votes are in the favour for style of functioning. So, the numbers are in favour of BJP. However there are always exceptions. There are some projects and policies that were promised by BJP to be accomplished by FY- 2019 like free gas cylinders provision for people below the Poverty Line, Housing for all by 2020, clean Ganga campaign, to name a few. So these conditions favour BJP. If BJP wins majority it will be the best combination for the market in terms of policies as the BJP government has always favoured the market. Not to forget that demonetization is still fresh in the minds of people and some sections suffered terribly and it was a groundbreaking decision. This was a promise for “clean economy”; however the economy dwindled with GDP and stock prices plummeting in late 2016. So, combining these factors the 2019 election will be a “Battle on the Battleground”.

Now According To People’s Opinion

80% citizens believe that elections will not have any impact on the stock market.

12% citizens believed that election’s impact will be very less on the stock market.

8% citizens believed that elections will impact on a large scale.

On 23rd January, 2018 Nifty 50 created history by crossing 11,000 points and Sensex crossed 36,000 points. So the corporate world has firm belief on Narendra Modi to drive the economy to newer peaks. By year 2025 it is believed that the economy will double up if the current policies and government continues its good governance. In FY-2019 the rating agencies have projected the GDP growth to be between 7.4% - 8.0%. Combining all these factors the market indices will move up and all credit to good governance, Foreign Institutional Investors and policies implementation. The last six elections have shown positive trends for Indian stock market irrespective of whether the power and party have changed or remained same.

Stock market takes a bullish or a bearish trend depending upon the changes and announcement which is mostly done by the elected candidate based on infrastructure, privatization, levying of tariffs, creation of jobs, FDI etc. The pre- election trend can be seen with projects being stalled due to paucity of funds. The reason is that the capital is diverted for election so that there will be amiable reforms by political party and that would bolster the stock market as the investors will buy colossal stocks and there will be no dearth of shares for a given company.

From historical data it is found that if UPA comes to power then the government sector sees a boost with bullish stock prices and if NDA comes into power then the private firms and corporates go bullish. This has been the trend so far. But there are always outliers.

KNOW THE HISTORY

The previous general election was held from 7th April to 12th May, 2014. Let’s have a look at the data.

Marked in red is for the changes due to international

Clearly, towards the end of the election which was on 16th May, the index took an upward trend which shows that the market went bullish and was good for investors.

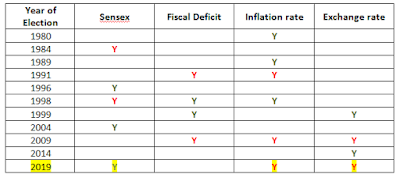

Below are a few data points regarding impact in Sensex, fiscal deficit, inflation rate and exchange rate due to Lok Sabha Elections

Marked in green is the changes due to election

The portion marked in yellow is the prediction that has been made. The Sensex will shoot up during the election as it is expected that PM Modi will come up with new investments and he has always been supportive for investors and risk takers. The platform will be favouring investors not only from India but also abroad

CUT THE NOISE

The Election Year 1991 Saw A 200% Increase In The Stock Index Within Nine Months Mainly Due To Economic Reforms, Strong Budget, But Not Due To Elections. It Was The Time When Harshad Mehta Scam Broke Out, Who Was Manipulating The Stocks. But Investors Misinterpreted The Stock Market And Thought That The Boom Was Due To Election, Which Was Not So. So Election Is Not The Only Reason For Stock Price Boom. There Are Various Internal And External Factors That Need To Be Looked Upon During An Election Year, But Not Through An Election Prism.

Similarly During The Year 1999 There Was A Coalition Government Formed At The Centre. Traders And Investors Thought It To Be A Stable Government And The Stock Indices Shoot Up, But It Was An Era Of Technology Boom; However When The Y2K Compliant Broke Out The Stock Indices Plummeted Within No Time.

KEY FINDING

Any news whether positive or negative is absorbed by the market and the market turns bullish in the upcoming days and in the long run the market returns around 12% to 15%. So, any adverse event doesn’t imply that the market will shut down; rather the market always sets its own pace. So, in an election year it is incumbent to keep a watch on the market news, sector news and upcoming events in the market which will definitely set the pace during the election year.

During the election year the opinion of investors changes very quickly which leads to market volatility. Investors feel there are some sectors which will rise but these buzz are not to be noted.

Citing with an example from 2014 General election, it was expected that the PSU banks will get a boom, but the ground reality was far divergent than the political reality. These are work done by the speculators who spread the banter just to earn money but it’s far true from reality. Elections are the best time to make money but with proper analysis of the news. From Political Perspective Below Are A Few Stocks Listed, That Will Definitely Expect A Political Favour If BJP Wins:

Reliance Industries.

Adani Steel.

Adani Power.

Adani Ports and Special Economic Zone Limited.

Adani Enterprises.

Larsen & Tubro Infratech.

OUTLOOK

BJP’s reign is likely to continue till FY-2024. The growth rate is expected to be around 7.5% to 8.0% in the year 2019. The stock market is expected to boom during the election year. The brokers have already smelled BJP’s victory and the market seems to have priced itself for second tenure. The years 2000’s were the “Golden years” for manufacturing and it saw a boom in the 1999 election. But 2019 will see a boom in the IT stock due to Artificial Intelligence (AI) implementation by Indian IT conglomerates. But people will credit election for the boom rather AI. So, it comes down to proper fundamental analysis of market news and expectation. From political angle the Ambani-Adani firms like Reliance industries and Adani Steel, Power etc will see a boom. Similarly the Aditya Birla Group led by Kumar Managalam Birla will look for party favour from 2019 election.

Below is a list of companies that favored nepotism from BJP in 2014 election:

But if BJP fails to win which is unlikely, then the market will crash by minimum 10%.

Thus culminating the writing,

“Share market is entirely based on confidence of the investors and current news. The Lok Sabha election will have a short term yet a strong impact on the stock market.”

Author by Trade Nivesh

0 Comments